All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash money value of an IUL are typically tax-free up to the quantity of costs paid. Any kind of withdrawals above this amount might be subject to taxes depending on policy structure.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for a minimum of 5 years and the individual is over 59. Possessions taken out from a typical or Roth 401(k) prior to age 59 might incur a 10% fine. Not exactly The insurance claims that IULs can be your very own financial institution are an oversimplification and can be misleading for several factors.

You may be subject to updating linked health and wellness inquiries that can impact your ongoing costs. With a 401(k), the cash is constantly yours, consisting of vested employer matching no matter whether you stop adding. Threat and Assurances: First and primary, IUL plans, and the cash money value, are not FDIC insured like basic financial institution accounts.

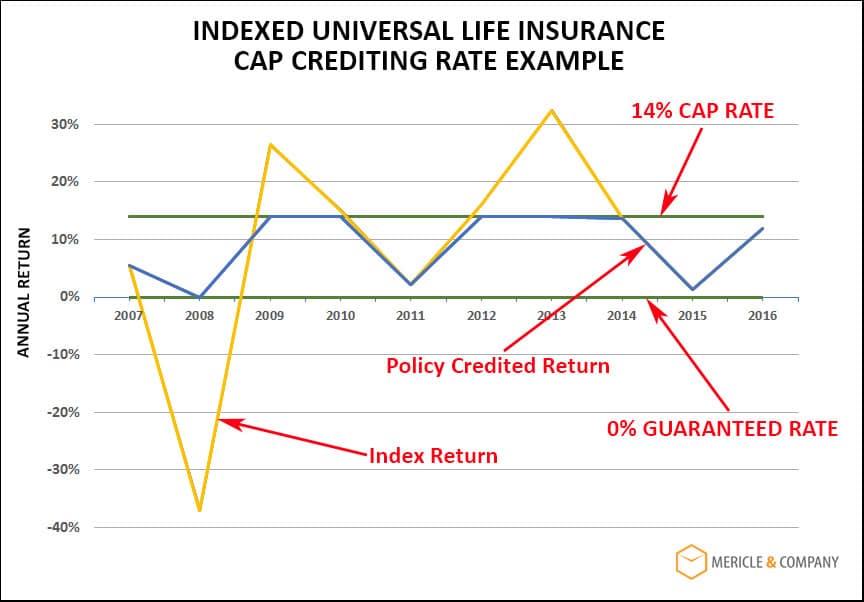

While there is commonly a floor to stop losses, the development capacity is capped (indicating you may not completely gain from market growths). Most specialists will concur that these are not equivalent products. If you desire survivor benefit for your survivor and are worried your retirement financial savings will not be enough, then you might wish to take into consideration an IUL or various other life insurance product.

Sure, the IUL can give access to a money account, however once more this is not the primary purpose of the item. Whether you desire or require an IUL is a very private question and relies on your key monetary purpose and goals. Nonetheless, listed below we will attempt to cover advantages and limitations for an IUL and a 401(k), so you can additionally define these products and make a much more informed decision pertaining to the most effective means to manage retirement and looking after your enjoyed ones after death.

Whats An Iul Account

Funding Expenses: Loans against the plan accumulate rate of interest and, if not settled, decrease the fatality advantage that is paid to the recipient. Market Participation Limitations: For most plans, financial investment growth is tied to a supply market index, but gains are generally topped, limiting upside possible - iul iscte. Sales Practices: These policies are often sold by insurance coverage representatives that may highlight advantages without completely explaining prices and dangers

While some social media experts suggest an IUL is a replacement item for a 401(k), it is not. These are different products with various objectives, attributes, and expenses. Indexed Universal Life (IUL) is a sort of permanent life insurance policy policy that likewise provides a cash worth element. The cash money value can be made use of for numerous objectives consisting of retirement savings, additional earnings, and other monetary needs.

Latest Posts

What Does Iul Stand For

Aig Index Universal Life Insurance

Iul Life Insurance Dave Ramsey